Question: What is term life insurance?

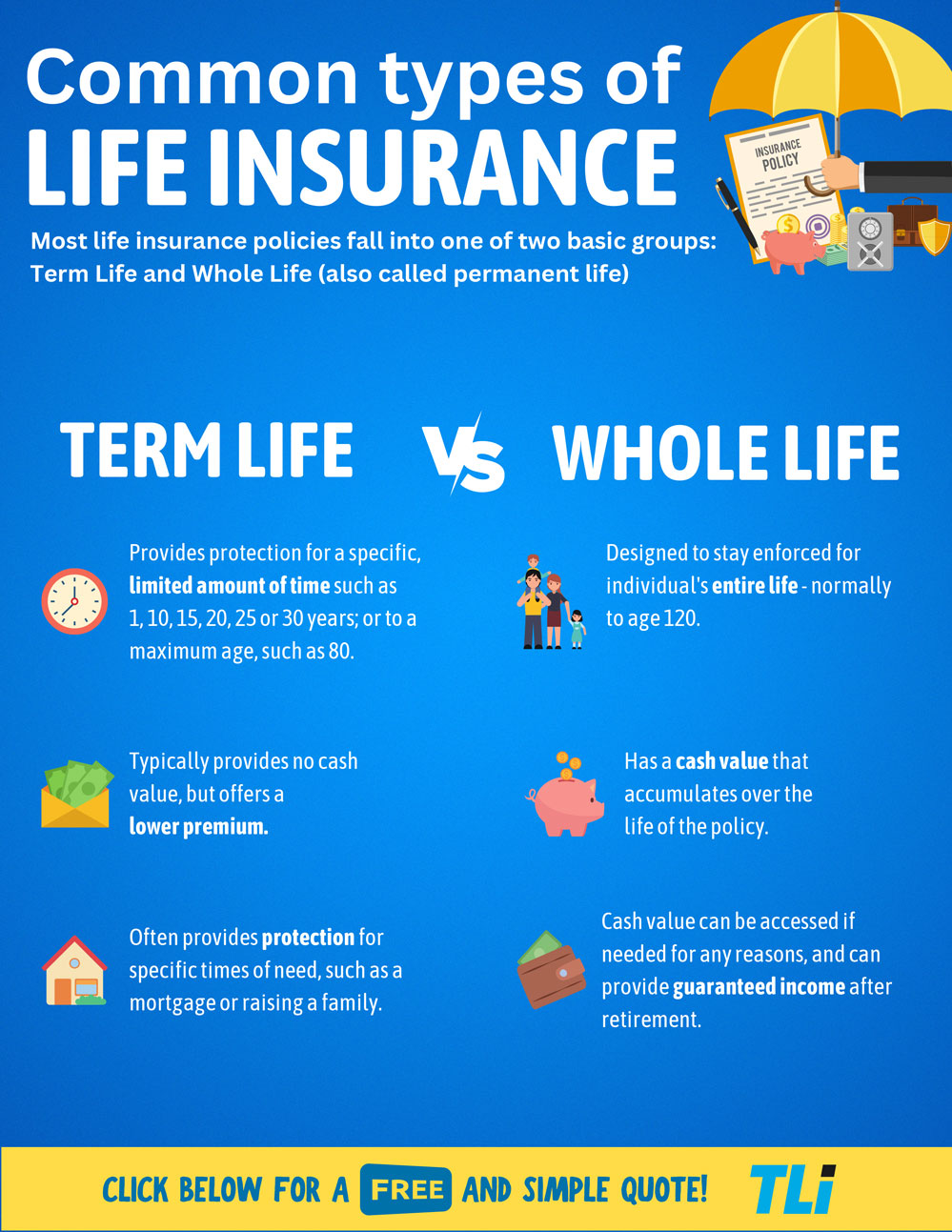

Answer: Term life insurance is a type of life insurance that provides coverage for a specific period, typically 1,10,15, 20, 25, or 30 years. If the insured passes away during the term, the policy pays out a death benefit to the beneficiaries.

Question: How much term life insurance coverage do I need?

Answer: The amount of coverage you need depends on various factors, such as your income, debts, and the financial needs of your beneficiaries. As a general rule, consider a coverage amount that is 5-10 times your annual income.

Question: Is term life insurance more affordable than other types of life insurance?

Answer: Yes, term life insurance is typically more affordable than permanent life insurance policies like whole life or universal life. Since it provides coverage for a specific period, it has lower premiums.

Question: Can I renew my term life insurance policy after it expires?

Answer: Most term life insurance policies offer the option to renew, but the premiums may increase significantly. It’s essential to check the renewal terms and conditions before purchasing the policy.

Question: Can I convert my term life insurance into a permanent policy?

Answer: Many term life insurance policies offer a conversion option, allowing you to convert your policy into a permanent one without the need for a medical exam. It’s a valuable feature to protect against any health changes.

Question: Do term life insurance policies have any cash value?

Answer: No, term life insurance policies do not build cash value. Term focus solely on providing the death benefit you desire at the lowest cost.

Question: Can I add riders to my term life insurance policy?

Answer: Yes, some insurance companies offer riders that can be added to term life policies for additional benefits. Common riders include critical illness, disability, and accidental death riders.

Question: Is a medical exam required to get term life insurance?

Answer: It depends on the policy and the insurance company’s underwriting guidelines. Some term life insurance policies require a medical exam, while others offer “no medical exam” options with slightly higher premiums.

Question: Can I cancel my term life insurance policy if I change my mind?

Answer: Yes, term life insurance policies usually come with a “free look” period during which you can cancel the policy and receive a full refund of premiums paid. The duration of the free look period varies by state and insurer.